What’s New: TruckLogics now integrates with Samsara, the pioneer of the Connected Operations Cloud, for faster IFTA Reporting! Learn More

What is IFTA?

Updated on July 01, 2024 - 2:00 PM by Admin, TruckLogics

The International Fuel Tax Agreement (IFTA) is an agreement made between the 48 contiguous US states and 10 Canadian provinces that intends to simplify the process of fuel tax reporting for motor carriers that operate in multiple jurisdictions.

Before the establishment of IFTA, each state had its own set of fuel tax reporting requirements, and the owners or operators of interstate motor vehicles had to obtain fuel permits from each of the states they traveled.

With TruckLogics IFTA tax reporting, qualified motor vehicle owners can report the fuel and distance data of their vehicles to the base jurisdiction every quarter. Based on that, the base jurisdiction will collect and distribute the taxes to other jurisdictions automatically.

Who's required to Complete IFTA Reporting?

IFTA reports must be filed by anyone who owns or is responsible for a Qualified Motor Vehicle (QMV).

A qualified motor vehicle is a motor vehicle used, designed, or maintained for the transportation of persons or property having:

- Two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms; or

- Having three or more axles regardless of weight; or

- Is used in combination, when the weight of such combination exceeds 26,000 pounds or 11,797 kilograms gross vehicle or registered gross vehicle weight.

QMVs do not include recreational vehicles unless they are used in conjunction with any business endeavor.

What are the IFTA Requirements?

There are certain requirements established under IFTA that the motor carriers must comply with. Here are they,

- Registration with base jurisdiction -The QMV must be registered in your base jurisdiction (where your business is located) and must have obtained an IFTA license, if applicable.

- Record Keeping -You must maintain the records of your business within the base jurisdiction.

- Fuel Tax Reporting -You must file IFTA reports for every quarter that covers all of your qualifying vehicles and pay any taxes due. It is recommended that you keep receipts for all fuel purchases.

Apart from these, each jurisdiction may have a separate set of requirements.Find out the IFTA requirements for your base jurisdiction.

Information Required for IFTA Reporting

As mentioned earlier, each jurisdiction may have slightly different requirements when reporting. Below, however, is a list of the general information required togenerate IFTA Reports, regardless of jurisdiction.

- Business Information - EIN, the name of the company, the type of business, and the address.

- IFTA details - Country, base jurisdiction, and the IFTA Account Number need to be submitted.

- Vehicle Data - Details about the vehicle, such as the truck/unit number, gross vehicle type, fleet name, fleet number, make, and model may need to be provided.

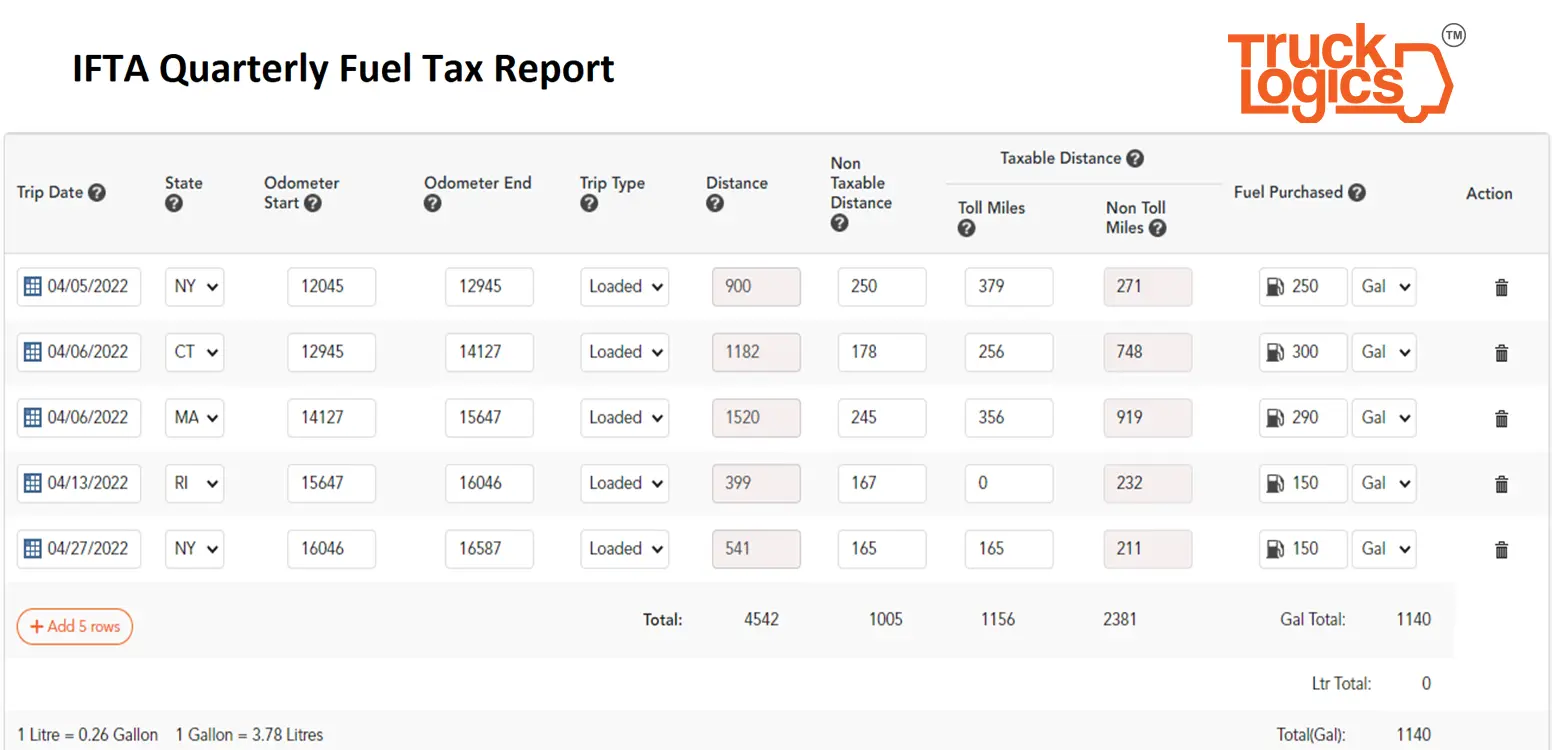

- Distance Data - The total miles, taxable and nontaxable, traveled by the IFTA licensee’s qualified motor vehicle(s) in all jurisdictions/states, regardless if they participate in IFTA. This includes all trip permit miles.

- Fuel Data - Fuel type, the total gallons or liters of fuel purchased, and the amount consumed by qualified motor vehicles.

IFTA Reporting Due Dates

IFTA reports are due on the last day of the month following the end of the quarter.

Even if the carrier has no operations or utilized taxable period for the concerned period a report must be submitted.

| Quarter Period | IFTA Quarterly Tax Return Due Dates |

|---|---|

| January - March 2025 1st Quarter |

April 30 , 2025 |

| April - June 2025 2nd Quarter |

July 31, 2025 |

| July - September 2025 3rd Quarter |

October 31, 2025 |

| October - December 2025 4th Quarter |

February 2, 2026 |

Note:If the due date falls on a weekend or public holiday, then the due date will be on the next business day.

Learn more about IFTA Filing dates

Late Filing Penalties for IFTA

Based on the jurisdiction rules and the number of months of late filing, the penalty amount of IFTA will be charged.

The penalty amount will be $50 or 10% of the net tax liability. Additionally, interest will be added to all late tax payments.

Meet your IFTA Reporting Requirements Easily Using TruckLogics!

TruckLogics, the leading Trucking Management Software, provides you with a hassle-free solution to generate IFTA Reports in State-specific formats.

-

Our IFTA Reporting software allows you to import distance and fuel data in multiple ways,

- Enter the details manually

- Bulk upload using our Excel templates

- Import from Motive

- Our system is automatically updated with tax rates for all jurisdictions every quarter, enabling you to generate your IFTA reports with accurate fuel tax calculations.

- An internal audit will be performed to ensure the accuracy of your reports.

- You can generate the IFTA Reports in state-specific formats.

Only pay for the report you generate