IFTA, International Fuel Tax Agreement, requires vehicles that operate in multiple jurisdictions to keep track of the miles traveled and the fuel purchased in all participating jurisdictions. At the end of the quarter, an IFTA report must be filed by the motor vehicle operators with their base jurisdiction. After the ELD mandate came into existence, the operators of vehicles covered by this law must use electronic logging devices, referred to as ELDs. These devices, fitted to the vehicle, replace the manual recording of the driver activity, including driver hours of service and

record of duty status.

One of the challenges faced by these operators is on the quarterly IFTA reporting. Though the information for reporting is available in the electronic logging device (ELD), entering the miles traveled and fuel expenses against each jurisdiction all over again is time-consuming and prone to mistakes. Also, incorrect filing may result in penalties. Motive’s ELD customers were looking for a solution to generate IFTA reports based on the information stored in their ELD devices without having to enter them

all over again.

TruckLogics to the Rescue

What if the operator can directly import information on the miles traveled and fuel expenses from the ELD devices into TruckLogics using a user-friendly interface? That's precisely the solution that TruckLogics can provide.

Once the user connects the Motive account with TruckLogics, they can easily import the Trip and Fuel reports from Motive’s account into TruckLogics to generate the IFTA Reports seamlessly. Data validations are in place to match the trucks and the drivers with the data being imported. Provision to verify and amend the report is also available.

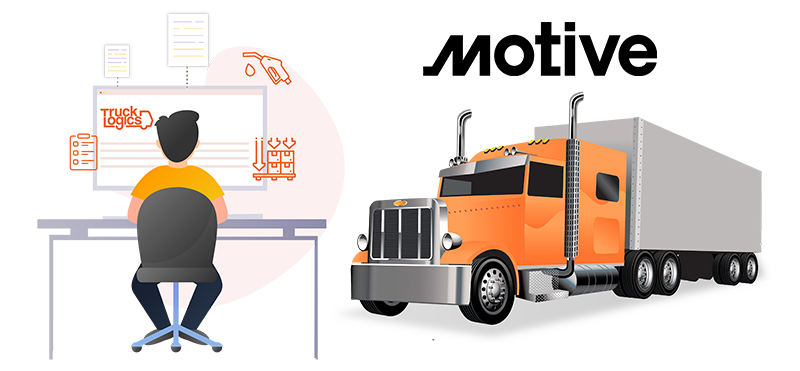

Here’s what TruckLogics has to offer:

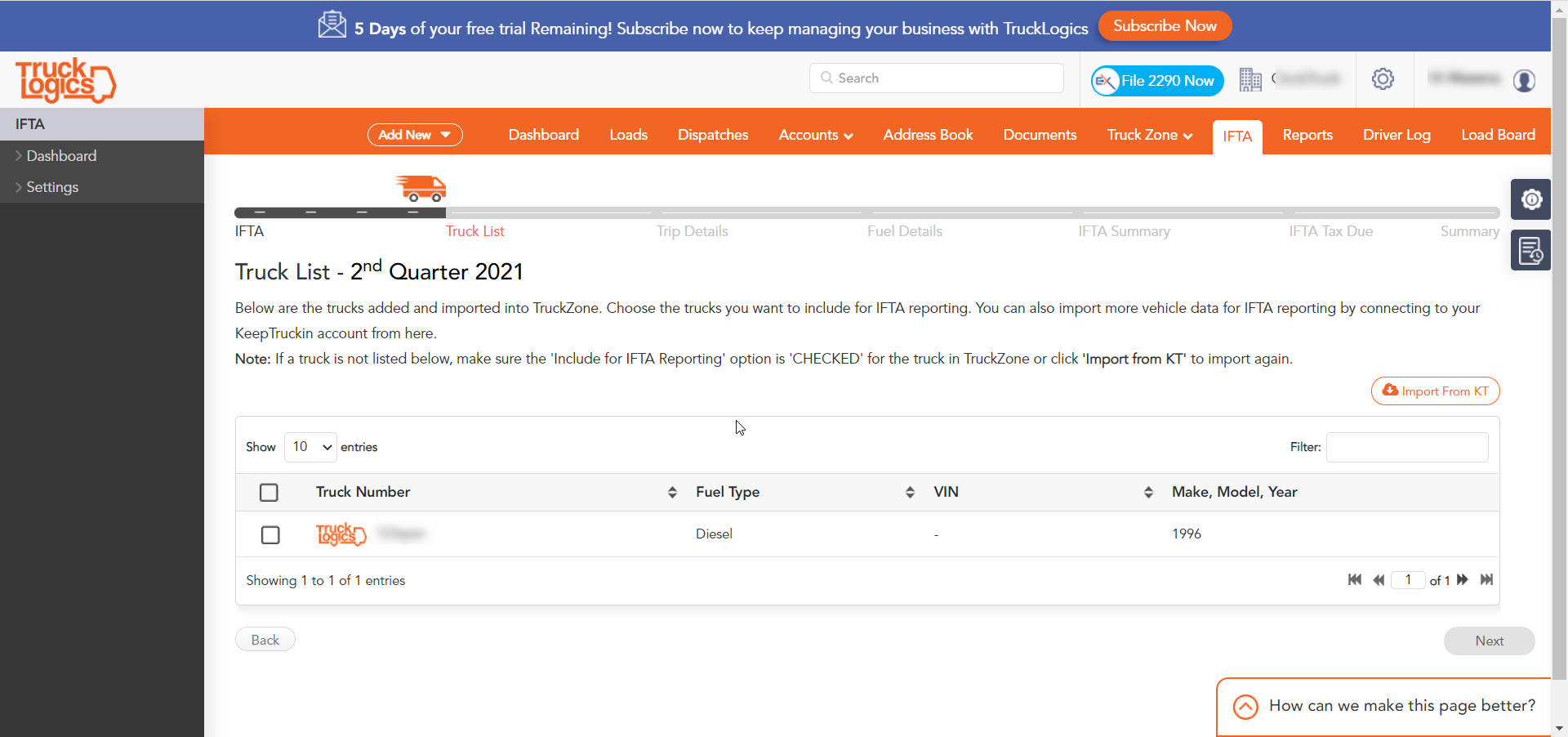

- Add trucks manually or Import them from Motive with the option to mark for IFTA reporting. Ensures that Trip and Fuel reports imported are only from ELDs associated with these trucks.

- Add drivers who drive these trucks. Validations are in place to make sure the Trip and Fuel reports from ELDs match these driver details.

- No more double entry for IFTA reporting. User engaging feature to import the Trip and Fuel reports from Motive’s ELDs in a few clicks.

- Automatically calculates the tax rate for each jurisdiction for the fuel type reported.

- Automatically calculates the Tax Due/Credit Earned for each jurisdiction based on miles per gallon (MPG).

- Calculation of Interest on the tax due for late or amended returns.

- Calculation of Penalties for late-filed returns, failure to file, or underpayment of tax due.

- Calculation of Total Remittance based on the Tax Due/Credit Earned, Interest, and Penalties.

- Generates IFTA Report with instructions on filing, payments, and the mailing address.

CASE STUDY

Shelby Corporation LLC has an owner-operator account with TruckLogics based out of California jurisdiction. The truck they operate is fitted with Motive’s electronic logging device (ELD) to record the driver's activities.

Though they record the mileage and expenses in TruckLogics, they still want to generate an IFTA report with information from the ELD device.

Let us look at how Shelby Corporation LLC can generate IFTA Report for the fiscal quarter from within TruckLogics without double entering the information from the ELD device.

Import Trucks from Motive

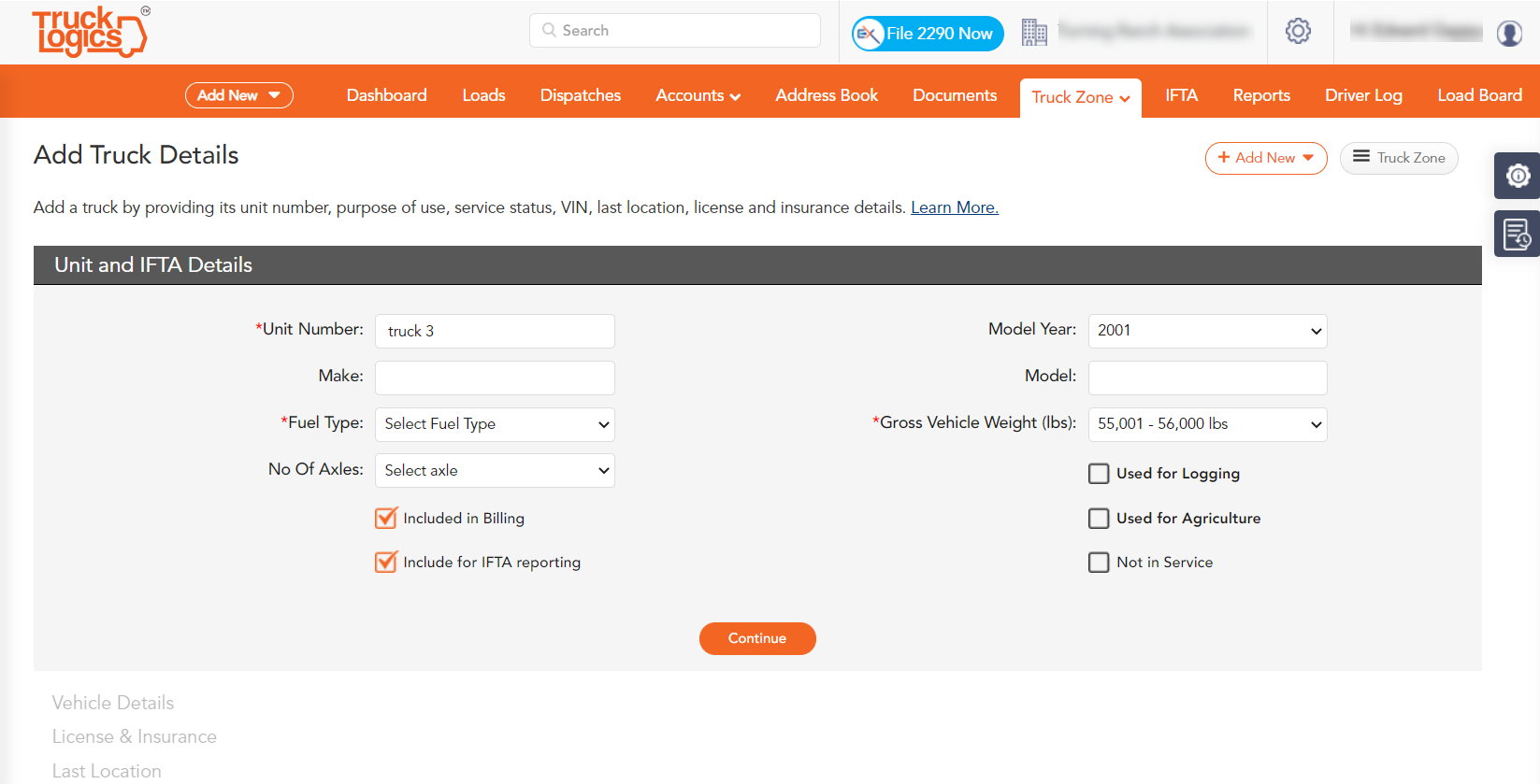

TruckLogics allows vehicles to be added with the option to include/exclude them for IFTA reporting. For example, in Shelby Corporation LLC, the truck details can be either added manually or imported from the Motive’s ELD fitted in them and added to TruckLogics.

By doing this, TruckLogics ensures the information from the correct ELD device is being reported for IFTA.

Set Base Jurisdiction

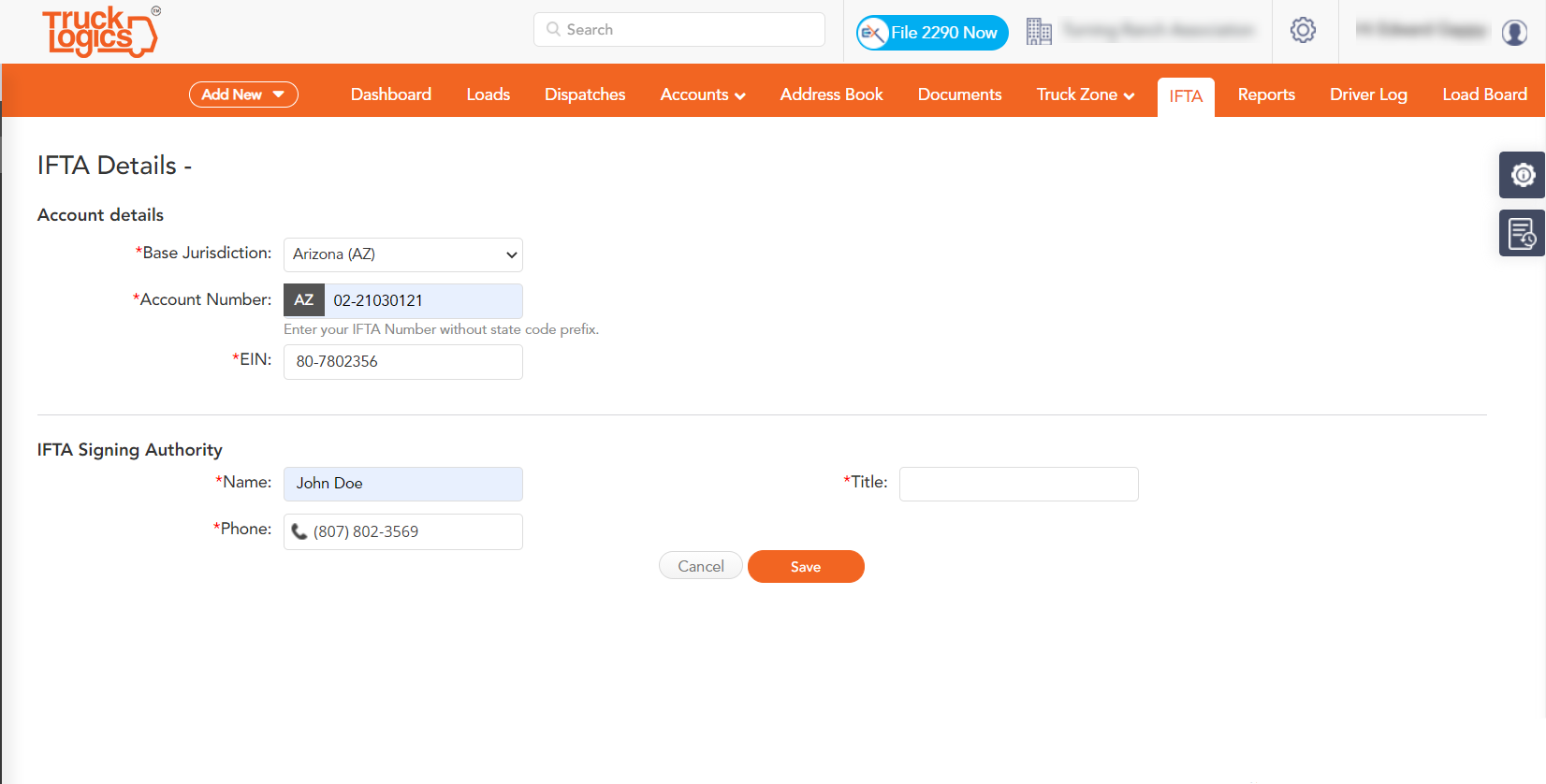

IFTA has to be reported through the operator’s base jurisdiction every fiscal quarter, and IFTA taxes due must be paid by the deadline. In addition, the reporting requires fuel and mileage data broken down for each jurisdiction traveled.

Shelby Corporation LLC must first set up the Base Jurisdiction and IFTA Signing Authority from IFTA >> Settings before generating the IFTA report.

Time to generate IFTA?

TruckLogics provides two options to generate IFTA Reports. Generate from the miles traveled and fuel expense information stored within TruckLogics, or use the import feature to pull in the information from Motive’s ELD device fitted in the truck.

Since Shelby Corporation LLC wants to generate IFTA based on the information available on the Motive’s ELD device, they should choose the Motive option.

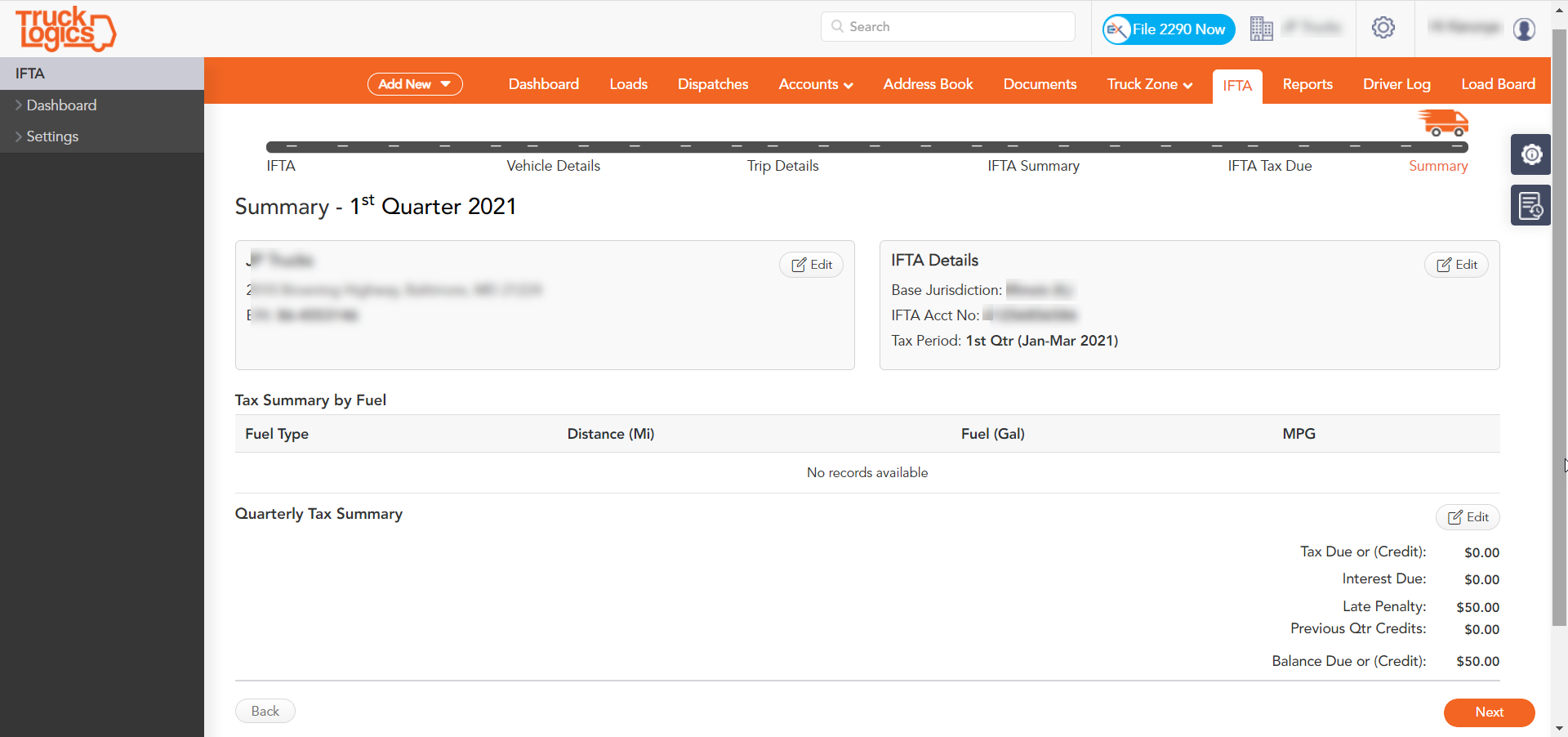

Calculation of IFTA Taxes and Penalties

TruckLogics automatically calculates the IFTA taxes based on the base jurisdiction. A penalty of $50 or 10% of the net tax liability, whichever is greater, is assessed for late filing, failure to file, or underpayment of tax due.

There is still a $50 penalty for late filing, even if the net tax liability is zero or a credit. However, penalty, if any, for late filing and late payment is automatically accounted for, with the option to override these amounts based on the net tax liability.

Payments may be made by Check or Money Order.

IFTA Report is Now Available

Based on the mileage and fuel expense information imported from the Trip and Fuel reports of Motive’s ELD devices, the IFTA return is generated. It is available for download in PDF format.

Corrections to the IFTA Report?

Shelby Corporation LLC may have chosen the incorrect base jurisdiction or want to change the trip miles or the fuel expenses after the IFTA Reporting PDF is generated. Information on the credits and penalties may have to be changed.

TruckLogics allows the modification to the IFTA report that was last generated. Thus, a new version of the report is generated, and the earlier versions are available for future reference.

Payments may be made by Check or Money Order.

In Summary

Operators whose vehicles are fitted with Motive’s ELD devices can now use TruckLogics to generate quarterly IFTA reports by importing the information from the ELD devices fitted in the vehicles.

To learn more about how TruckLogics Simplifies IFTA reporting for Fleet Owners, click here.